SPEAK WITH AN APPRAISER

(786) 357-6511

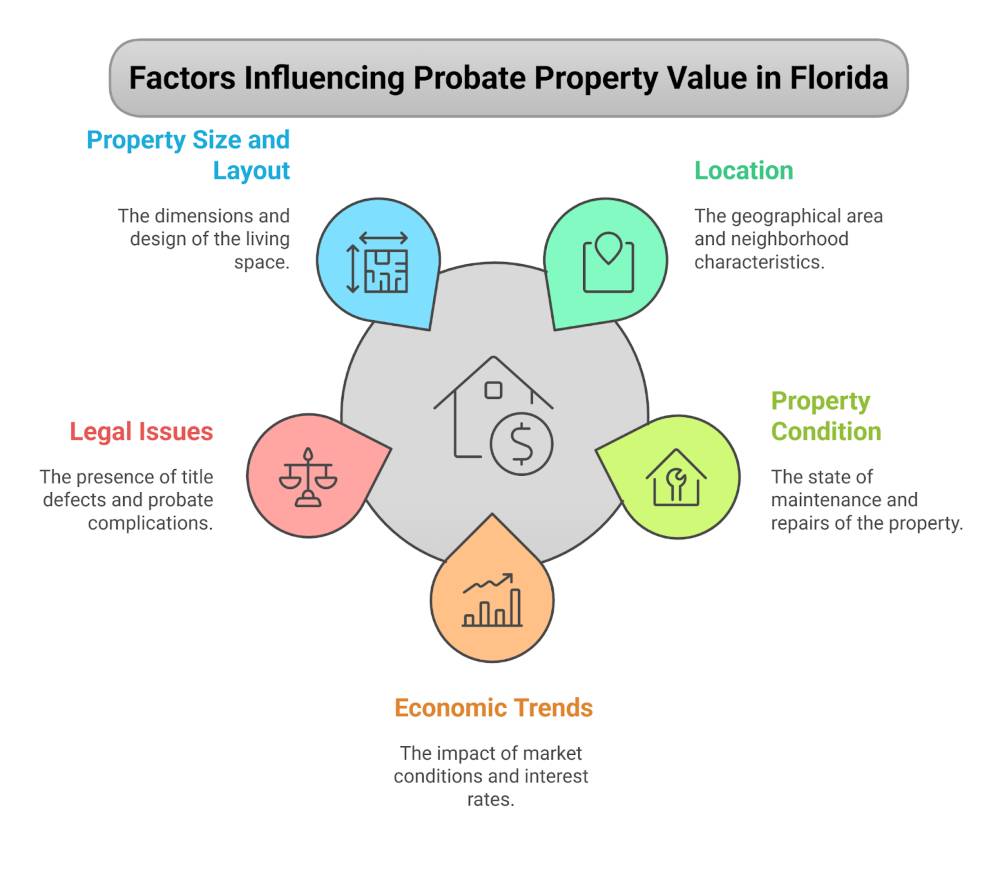

Probate property in Florida can be tricky to value. Many factors affect how much a property is worth during the probate process. These factors can change how much money heirs get from an estate.

Knowing the key things that impact probate property value in Florida helps people plan better for the future.

This article examines five major factors affecting probate property values in the state and provides useful tips for those who deal with probate real estate.

The location of a probate property plays a key role in determining its value in Florida. Properties in desirable areas tend to fetch higher prices. Coastal regions, for example, often command premium values due to their proximity to beaches and scenic views.

Urban centers like Miami, Orlando, and Tampa typically have higher property values than rural areas. This is due to the better job opportunities, amenities, and infrastructure in cities.

The quality of the neighborhood also impacts property value. Factors like crime rates, school districts, and local businesses all contribute to a property’s desirability. Properties in safe neighborhoods with good schools are usually more valuable.

Florida’s unique geography also affects property values. Some areas are more prone to hurricanes or flooding, which can lower property values. Conversely, properties in hurricane-resistant zones might be worth more.

Proximity to popular attractions can boost a property’s value. Homes near theme parks, shopping centers, or cultural landmarks often sell for higher prices, especially in tourist-heavy areas of Florida.

Local zoning laws and future development plans can also influence property values. Areas slated for new infrastructure or commercial development may see property values rise in anticipation of these changes.

The condition and maintenance of a property play a crucial role in determining its value during probate in Florida. Well-maintained properties often fetch higher prices compared to those in poor condition.

Regular upkeep and repairs can significantly impact a property’s worth. This includes maintaining the roof, HVAC systems, plumbing, and electrical systems. A property with updated features and modern amenities tends to be more valuable.

Curb appeal is another important factor. A well-manicured lawn, attractive landscaping, and a clean exterior can make a positive first impression on potential buyers and increase the property’s value during probate.

Neglected properties may require substantial investments to bring them up to market standards. This can lead to lower valuations and potentially longer selling periods. Executors should consider addressing any major maintenance issues before listing the property.

It’s important to note that probate delays can affect the property’s condition. Extended periods without proper care may result in deterioration, potentially reducing the property’s value.

Regular inspections and necessary maintenance during the probate process can help preserve the property’s worth.

Documenting the property’s condition with photographs and professional assessments can provide valuable evidence for accurate valuation.

This information can be crucial when negotiating with potential buyers or addressing any disputes that may arise during the probate process.

Selling a probate property in Florida? Ensure you get the right valuation with Home Value Inc. Our certified appraisers provide accurate assessments for a smooth estate process. Get your consultation today!

If you’re ready to get started, call us now!

The probate real estate market in Florida is shaped by broader economic trends. Interest rates, consumer purchasing power, and overall market conditions affect property values.

In 2025, the probate real estate market will offer unique opportunities for investors and buyers. The demand for probate properties can shift based on the general real estate market’s health.

When the market is hot, probate properties may sell quickly and for higher prices. In slower markets, these properties might take longer to sell and fetch lower prices.

Local market conditions also matter. Some Florida areas might see high demand for probate properties, while others may have less interest. This can affect how much a probate property is worth.

Current market trends influence the value of items inside probate homes, and vintage furniture or rare collectibles might be worth more if they’re in style.

Keeping an eye on Florida’s real estate trends helps predict probate property values. This includes watching home prices, sale times, and buyer preferences in different parts of the state.

Don’t let hidden issues affect your probate property’s value. Home Value Inc. offers expert appraisals to help you navigate market trends and legal complexities. Contact us for a professional valuation!

If you’re ready to get started, call us now!

Legal and title issues can significantly affect the value of probate property in Florida. These problems may lead to delays in the probate process and increase costs for the estate.

One common issue is defects in the decedent’s title. This can include incorrect legal descriptions or invalid deed executions. Such defects may require additional legal work to resolve, potentially reducing the property’s value.

Probate administration might be necessary for certain real estate title issues. This process ensures that debts and taxes are settled before asset distribution, which can impact the final value of the property.

Disputes among heirs or beneficiaries can also arise during probate. These conflicts may lead to legal challenges, prolonging the process and potentially decreasing the property’s market value.

Tax implications are another crucial factor. The estate is responsible for property taxes during probate, and capital gains taxes may apply if the property is sold. These financial obligations can affect the overall value of the estate.

To address these issues, executors often need to work with probate attorneys. Legal expertise can help navigate complications and minimize their impact on the property’s value.

Florida has specific laws and steps for handling estates after someone dies. These rules affect how property is valued and distributed.

Understanding Probate Law

Florida Probate Code governs the probate process in the state. It sets rules for managing and distributing a deceased person’s assets.

The code covers:

Probate is needed for assets solely in the deceased’s name without named beneficiaries. This includes real estate and some bank accounts.

Florida law aims to protect creditors, ensure fair asset distribution, and make the process as smooth as possible for families.

The Florida probate process involves several important steps:

Florida offers different types of probate based on the estate’s value. Formal Administration is used for estates over $75,000, while Summary Administration is used for smaller estates.

The court appoints a personal representative to manage the estate. This person has legal duties to follow Florida probate laws and act in the estate’s best interest.

Maximize your probate property’s worth with a trusted appraisal from Home Value Inc. Our detailed reports help heirs and executors make informed decisions. Schedule your probate valuation now!

What factors affect the valuation of probate property in Florida?

The value of probate property in Florida depends on several factors. Location plays a crucial role in determining property value. Properties in desirable areas often command higher prices.

The condition and maintenance of the property also impact its value. Well-maintained homes typically fetch better prices than those needing repairs.

Also, Market trends influence property values. A strong real estate market can boost prices, while a downturn may lower them.

What steps are involved in the Florida probate process?

The Florida probate process involves several steps. First, a petition to open probate is filed with the court, which then appoints a personal representative.

Next, the personal representative notifies creditors and beneficiaries. They also inventory and appraise the estate’s assets.

The personal representative pays valid debts and taxes. Finally, they distribute the remaining assets to beneficiaries according to the will or Florida law.

What is the order of distribution for estates during Florida probate?

In Florida probate, estate distribution follows a specific order. First, the personal representative pays the costs of administering the estate.

Next, they pay any outstanding funeral expenses and settle any debts owed by the deceased.

Finally, the remaining assets go to the beneficiaries named in the will. If there’s no will, assets go to heirs according to Florida intestacy laws.

Is probate necessary for all estates in Florida?

Not all estates in Florida require probate. Some assets can be transferred directly to beneficiaries without going through probate.

These include assets with designated beneficiaries, like life insurance policies and retirement accounts. Joint bank accounts and property held in joint tenancy also bypass probate.

Small estates may qualify for simplified probate procedures, making the process quicker and less costly.

What is the threshold estate value that requires probate in Florida?

Florida law sets specific thresholds for probate requirements. Estates valued at $75,000 or less may qualify for summary administration, a simplified probate process.

Estates worth more than $75,000 typically require formal administration. This process is more complex and time-consuming.

The value threshold doesn’t include homestead property or assets that pass outside of probate.

What are the responsibilities of a personal representative in Florida probate?

A personal representative in Florida probate has many duties. They must gather and protect the deceased’s assets.

They’re responsible for paying valid debts and taxes owed by the estate. The personal representative must also file necessary tax returns.

They must distribute assets to beneficiaries according to the will or Florida law. Throughout the process, they must act in the best interests of the estate and its beneficiaries.

Home Value Inc. performs residential and commercial appraisals for its clients in greater Miami-Dade County and the following cities in South Florida. We provide services to the following cities -