SPEAK WITH AN APPRAISER

(786) 357-6511

Preparing your home for an appraisal can be overwhelming. Papers pile up, repairs call out for attention, and small details get missed.

A clear pre-appraisal checklist helps homeowners organize their efforts, making the process stress-free and straightforward.

This article cuts through the confusion and shows how the right steps can increase a home’s value.

From cleaning and repairs to tackling common red flags, readers will discover helpful tips to put their best foot forward.

For a detailed home appraisal checklist, check out this guide for homeowners.

Knowing what to expect makes a big difference on appraisal day. Homeowners who prepare thoughtfully have the best chance of maximizing success with confidence and clarity.

A home’s appraisal determines its market value, which directly affects both its selling potential and negotiating power.

Small details, such as clutter or overdue repairs, can make a significant difference during the appraisal process.

Appraisal values often set the starting point for price negotiations. If the appraisal comes in lower than expected, lenders may not approve a buyer’s mortgage for the price the seller wants. This can lead to the deal falling through or the seller having to lower the price.

A strong appraisal can help a seller justify a higher asking price and facilitate a quicker sale. Real estate agents know that a clean, cared-for house often appears more valuable.

Following simple home appraisal tips for sellers, like fixing leaky faucets and touching up paint, helps present the home at its best. Small improvements can result in a higher value.

Good lighting, well-maintained lawns, and functioning appliances convey to the appraiser that the property is well-kept.

The goal is to demonstrate that the home is maintained and stands out from similar homes in the area. A detailed pre-appraisal checklist helps sellers focus on these key tasks.

Many homeowners overlook minor repairs, assuming they are insignificant. Issues such as chipped paint, stained carpets, or broken door handles can detract from the home’s overall care and value.

Clutter is another major problem. Overcrowded rooms and yards can make spaces appear smaller and less inviting, distracting the appraiser and concealing the home’s best features. Deep cleaning and decluttering help reveal the true size and potential of every area.

Allowing the home to appear dark or messy during the appraisal creates a poor impression—a well-lit, odor-free, and organized property signals a sense of pride of ownership.

Sellers can prepare for an appraisal by ensuring all utilities are functional and all rooms are accessible. Avoiding these simple mistakes can lead to a higher and more favorable appraisal.

Thinking about listing your property soon? Get a clear, professional valuation with Home Value Inc.’s general home appraisal service—your first step toward a smooth, confident sale.

If you’re ready to get started, call us now!

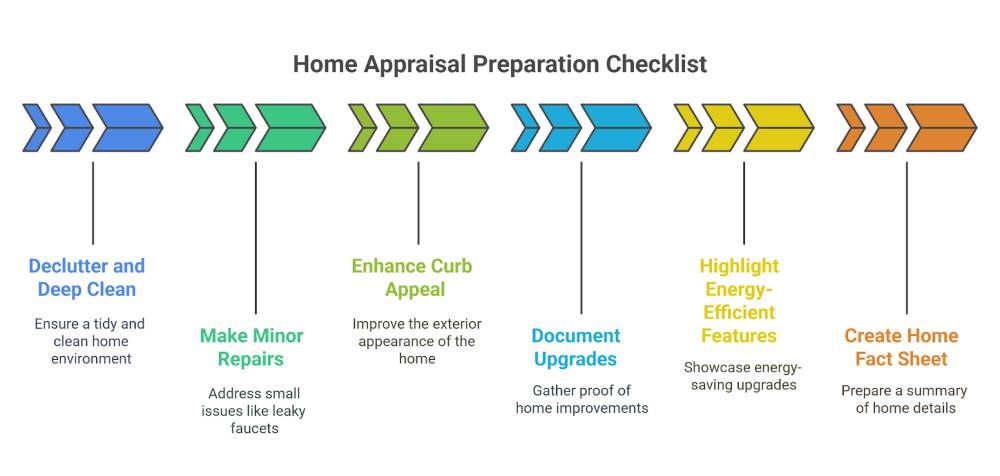

Getting ready for a home appraisal involves more than just cleaning—it’s about showing your property at its best.

Focusing on details like repairs, upgrades, and documentation will help create a strong first impression and support the appraiser’s work.

A clean and tidy space is essential. Appraisers look for signs that the home is well-maintained, so spending time here will always pay off. Go room by room and clear surfaces, store personal items away, and organize closets.

Vacuum carpets, mop floors, and wipe down counters and appliances. Clean windows let in more natural light, making rooms look bigger. Pet odors, dust, and cobwebs should be removed, as clutter and smells can distract from a home’s best features.

A deep clean helps show buyers and the appraiser that the property is ready for a new owner.

Cleanliness can have a positive impact on the appraisal process. Cleaning also helps identify issues that may require quick fixes.

Before the appraisal, take the time to address small issues that may be noticeable during an inspection.

Look for leaky faucets, chipped paint, squeaky doors, or broken light fixtures. Even minor damages can signal neglect and lower perceived value.

Check that all doors and windows open and close smoothly. Patch up holes or scuffs on walls, and replace burnt-out bulbs. Test smoke detectors and replace batteries if needed.

Taking care of minor repairs improves a home’s appearance and shows that ongoing maintenance is a priority.

First impressions start long before a person walks through the front door—Freshen landscaping by mowing the lawn, trimming shrubs, and raking leaves. Remove debris, weeds, and dead plants from the yard and flowerbeds.

Power-wash sidewalks and driveways for a clean look. If needed, add fresh mulch or potted plants near the entryway. Repaint or replace an old mailbox and fix house numbers if they look faded.

A tidy, welcoming exterior can sway an appraiser’s opinion of the home’s upkeep.

Gather proof of any updates, such as invoices, permits, and before-and-after photos, to document the changes. Improvements like a remodeled kitchen, a new roof, or updated bathroom fixtures should be listed and ready to show.

List major upgrades with dates and costs. If a recent project increased energy efficiency, note it in your paperwork. Appraisers need reliable information to verify that changes add property value, so keep documents organized for a quick review.

Documentation gives the appraiser confidence that the home was improved with care. This is a key tip in many essential appraisal checklists because it is much easier to support a higher valuation when the facts are clear and well-documented.

Energy-saving upgrades are a strong selling point and should not be overlooked. Make a list of each addition, such as new windows, insulation, a tankless water heater, or Energy Star appliances. Leave out product manuals for new systems.

Have paperwork showing installation and savings for solar panels or smart thermostats.

During the walk-through, point out extra attic insulation or LED lighting. These details set a home apart in the appraiser’s notes and can appeal to lenders and future buyers who value lower utility bills.

Prepare a simple fact sheet about the property. Include square footage, the year it was built, the number of bedrooms and baths, and significant upgrades or repair dates. You should note school districts, recent utility costs, or neighborhood amenities.

A home fact sheet helps guide the appraiser during the inspection. It can prevent missed details and ensure features stand out in the final report.

An organized sheet also saves everyone’s time by answering common questions before they arise.

Keeping this information clear and readily available makes the process smoother, which is strongly recommended in expert property appraisal checklists.

This shows respect for the appraiser’s time and highlights your preparation as a homeowner.

Proper home preparation can increase appraisal value and highlight critical areas where upgrades deliver the best return.

Focusing on the most impactful rooms and home systems will enhance the appraiser’s property rating.

Kitchens and bathrooms are top priorities for maximizing appraisal value. Simple updates, such as new hardware, faucets, or light fixtures, can modernize these spaces.

Deep cleaning, decluttering, and fixing obvious issues, such as broken tiles or damaged countertops, show that the home is well-maintained.

Upgrades to energy-efficient appliances or new cabinets can also add appeal. According to many experts, kitchen and bathroom remodels have some of the best returns on investment (ROI) for home appraisal.

Surface-level updates, such as painting cabinets or regrouting tile, are affordable ways to enhance style without a full renovation.

Prioritize:

Extra living areas, such as finished basements or attics, increase usable square footage. This is especially important because appraisers consider total living space in their assessment.

Well-finished basements can function as family rooms, home offices, or guest areas. Properly finished attic spaces offer cozy bedrooms or creative nooks.

Ensuring these areas are clean, dry, and well-lit will work in the homeowner’s favor. Double-check that permits were pulled for finished spaces, as appraisers may only include areas with proper documentation.

Checklist:

Functional home systems signal to appraisers that the property is well-maintained. Heating, cooling, plumbing, and electrical systems should all work properly and have no visible issues.

A recent HVAC service or an updated electrical panel can provide reassurance to the appraiser about the home’s efficiency and safety.

Fixing leaky faucets, replacing air filters, and ensuring smoke detectors are working can help avoid negative marks.

For a smooth pre-appraisal process, create a checklist of key systems and test each one before the appraisal date.

To Do Before Appraisal:

| System | Action Item |

| HVAC | Replace the filter, and test the system |

| Plumbing | Fix leaks, check drains |

| Electrical | Test outlets, replace bulbs |

| Safety | Check smoke detectors |

Curb appeal also affects how the home is perceived, so keep lawns trimmed, walkways clear, and exterior paint touched up to maintain a well-maintained appearance. Proper system function and exterior care, when combined, can help boost appraisal value.

Paying for PMI when you don’t have to? Home Value Inc. can determine if you’ve built enough equity to eliminate it—request your PMI removal appraisal and start saving today.

If you’re ready to get started, call us now!

Before your appraisal day arrives, it is essential to stay organized and prepared. To make the process even easier, we’ve included a simple, actionable checklist below. Use it to ensure your home shines when it matters most.

| Action Item | Task Details | Completed (✔) |

| Declutter and Deep Clean | Clear all rooms of excess items, clean floors, counters, and windows thoroughly. Remove pet odors and dust. | |

| Make Minor Repairs | Fix leaky faucets, squeaky doors, chipped paint, broken fixtures, and burned-out lightbulbs. | |

| Enhance Curb Appeal | Mow the lawn, trim the hedges, clean the driveways, touch up the exterior paint, and freshen up the entrance. | |

| Document Upgrades and Renovations | Gather permits, receipts, and before/after photos of any home improvements or energy upgrades. | |

| Highlight Energy-Efficient Features | List items such as solar panels, new insulation, and smart thermostats, and include manuals if available. | |

| Create a Home Fact Sheet | Include square footage, bedrooms/bathrooms, year built, recent updates, and neighborhood features. | |

| Prepare Finished Spaces | Clean and organize finished basements, attics, and bonus rooms, ensuring proper documentation for these areas. | |

| Test Functional Systems | Check the HVAC, plumbing, electrical systems, smoke detectors, and appliances to ensure they are in proper working order. | |

| Provide Recent Comparables | Prepare a packet with comparable neighborhood home sales, including square footage and upgrade details, if available. | |

| Final Walkthrough | Open all rooms for easy access, secure pets, maintain tidy yards, and ensure the home smells fresh and inviting. |

A home appraisal involves a licensed professional visiting the property to assess its value based on its condition, features, and comparable properties in the area.

The visit typically lasts a short time, but thorough preparation is crucial for a positive outcome.

The appraiser acts as an unbiased third party hired by the lender or other party to determine the fair market value of a home. This process protects both the buyer and lender by ensuring the price matches the true value.

During an appraisal, the appraiser inspects the entire property. They look for the home’s overall condition, recent updates, number of bedrooms and bathrooms, square footage, lot size, and curb appeal. Major systems, including heating, cooling, plumbing, and electrical, will be noted, along with safety features such as working smoke detectors.

They also take photographs and record notes on specific features. The appraiser compares the home to similar recently sold houses in the neighborhood.

They may point out any repairs that could affect the value. The goal is to provide an accurate and impartial evaluation based on established standards.

The actual walk-through of the property often takes 30 minutes to an hour for an average-sized home. Larger properties or homes with special features may take longer. Busy markets or unique situations can add time to the process.

After the visit, the appraiser researches neighborhood sales data and finalizes the written report. Homeowners typically do not receive the results immediately, as the appraiser spends several days reviewing market data and photos before submitting their findings to the lender.

Preparation involves making the home easily accessible and organizing documentation, such as repair receipts.

Efficient scheduling and clear access to all rooms, including basements and attics, help speed up the process.

Appraisers are trained to spot issues that reduce a home’s value or slow the sale.

Homeowners should pay close attention to maintenance and the legality of any changes to their property, as these areas often trigger red flags during appraisal.

Appraisers are concerned about obvious neglect. They look for peeling paint, broken windows, leaking faucets, roof damage, water stains, and cracked foundations.

When a home is not cared for, it signals to an appraiser that there could be hidden problems elsewhere.

A messy yard, dirty floors, and old or broken appliances can also be signs that other critical repairs may have been ignored.

These issues, often listed as appraisal red flags, lower the home’s overall value in the appraiser’s report.

Proper maintenance can help avoid common home appraisal mistakes, even for small things.

Maintaining a clean home, fixing leaks, and managing yards or landscaping creates a strong first impression and signals that the property is well-maintained.

Quick Maintenance Checklist:

Appraisers often find unpermitted renovations or room conversions as key red flags that can jeopardize a sale. Examples include finished basements, attic bedrooms, or garage apartments that were built without the necessary permits.

If a space has been added or altered without adhering to local building codes, the appraiser’s value may not include that area of the home.

In some cases, lenders may refuse to finance the property due to these FHA appraisal red flags.

Homeowners should always check city or county records to ensure every change was legal and permitted. If any room or building addition is not allowed, it is best to work with the city to resolve the issue before the appraisal.

Common Illegal Conversion Mistakes:

Small changes during the appraisal visit can have a significant impact. Staying organized and knowing what to share can help homeowners obtain the best possible home appraisal.

Homeowners should be available when the appraiser arrives, but avoid hovering or following the appraiser through the house.

It is helpful to greet the appraiser, answer any initial questions, and then give them space to do their job.

Tips for making a positive impression:

An appraiser needs to focus so that interruptions do not distract from their evaluation. Being present, but not intrusive, helps the process stay smooth and professional.

This approach demonstrates respect for their expertise, maintaining a neutral and positive environment for both parties.

Providing the appraiser with a well-organized packet of recent, similar home sales (known as comparables or comps) in the area can be helpful. Highlight homes with matching features, such as size, age, and upgrades.

Important things to include:

Bringing up comps makes it easier for the appraiser to see how the home fits into the local market. This can lead to a more accurate and fair value.

Preparing your home for an appraisal during a life transition? Let Home Value Inc. handle your appraisal with accuracy and care—clarity starts with a precise valuation.

What should I do before a home appraisal?

Before a home appraisal, deep clean all rooms, complete minor repairs, enhance curb appeal, document upgrades, and test all major systems to ensure everything is functional and presentable.

How much do small repairs impact a home appraisal?

Small repairs, such as fixing leaks, patching walls, and replacing broken fixtures, can enhance a home’s perceived value and help avoid negative appraisal notes, potentially increasing the final appraised price by 2–5%.

Does a messy house affect the appraiser’s valuation?

While appraisers focus on the property’s structure and condition, cluttered or dirty homes can create a poor impression, making it harder for appraisers to assess the home’s true value accurately.

How important is curb appeal for a home appraisal?

Curb appeal significantly influences first impressions. Homes with clean exteriors, well-maintained landscaping, and welcoming entryways typically appraise 5–7% higher than those with poor maintenance.

Should I be home during the appraisal?

Yes, it is recommended that you be present to provide access and answer questions, but you should also allow the appraiser to work independently without hovering or interrupting their evaluation process.

What documents should I give the appraiser?

Provide a home fact sheet, a list of upgrades with receipts, energy-efficiency additions, and comparable recent home sales to help the appraiser accurately assess the home’s market value.

How long does a typical home appraisal take?

A standard home appraisal visit typically lasts 30 minutes to one hour, depending on the property’s size and complexity, with final reports submitted within a few days after market research is completed.

Home Value Inc. performs residential and commercial appraisals for its clients in greater Miami-Dade County and the following cities in South Florida. We provide services to the following cities -