SPEAK WITH AN APPRAISER

(786) 357-6511

During a property tax appraisal in Miami-Dade, homeowners can expect their property’s value to be reviewed based on recent market trends, comparable sales, and any improvements made to the property.

The Miami-Dade County Property Appraiser uses this information to decide the assessed value, which will affect the amount the owner pays in property taxes.

This yearly process is important because it can change the tax bill. Understanding how it works can help owners avoid surprises.

The appraisal isn’t random. The property appraiser follows rules set by the county and considers factors such as home improvements and recent sales in the neighborhood.

Knowing what goes into an appraisal helps owners recognize when their value is fair and when it might be worth asking for a review if something seems off.

If a homeowner disagrees with the value, there are ways to review or appeal it through the Miami-Dade property appraiser’s office.

Property taxes in Miami-Dade are based on regular appraisals managed by the county government.

These appraisals employ established methods and rules to determine the value of property, which in turn, determines the amount of tax an owner will pay.

A property tax appraisal is the process of finding the fair market value of a home, business, or land for tax purposes.

The Miami-Dade County Property Appraiser uses factors such as a property’s size, type, age, condition, and location, along with recent sales of similar properties, to determine its value.

These appraisals are important because they make sure taxes are fair and accurate for everyone. Owners typically receive a yearly property tax notice, which displays the assessed value and estimated taxes.

If there are errors or questions, property owners have the right to review or challenge the value.

Key points in a property tax appraisal:

The Miami-Dade County Property Appraiser is the official responsible for all property tax appraisals. This office employs trained staff and adheres to standard appraisal methods throughout the entire county.

The appraisers gather and review information using visits, public records, and digital tools. Property tax appraisals in Miami-Dade County happen once a year, usually before the start of the new tax year.

The Property Appraiser certifies the annual tax rolls in October, as required by Florida law.

Homeowners receive the property tax notice after assessments, which lists the values and expected taxes for the upcoming year.

This notice is essential for understanding the amount of tax due and the reasons behind it.

The property appraiser‘s office values all types of real estate within Miami-Dade County. This includes single-family homes, condominiums, apartment buildings, and other residential properties.

Commercial buildings, such as stores, warehouses, and office spaces, are also assessed. Vacant land and industrial properties are also included.

The county even assesses tangible personal property, which covers business equipment and furnishings. Each property is reviewed based on its type and use to make sure the value is accurate.

To see which types of properties are assessed or to check your appraisals, use the Miami-Dade County property tax estimator and online tools.

Do you need clarity on how your Miami-Dade property is valued? Home Value Inc. offers certified tax appraisal reports that help you understand where you stand. Contact us today to get started.

If you’re ready to get started, call us now!

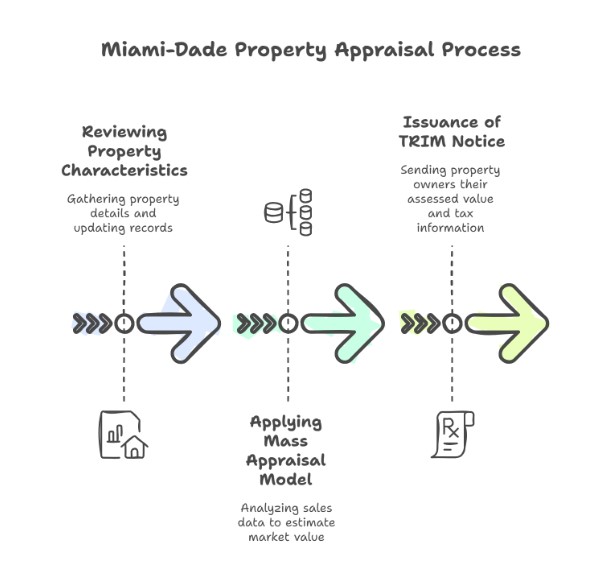

Miami-Dade’s property tax appraisal process relies on systematic reviews and data analysis. Each step affects the property’s assessed value and the tax amount owners may owe.

The Miami-Dade Property Appraiser’s Office starts by gathering details on each property. This includes square footage, lot size, year built, property type, and upgrades or renovations.

They also consider the number of bedrooms and bathrooms, the type of roof, and the condition of the structures. Accurate property records are vital because minor errors can change a home’s value.

Appraisers may use aerial images, permit files, and on-site visits to update their information. The data gets entered into an extensive database.

Owners should keep records of any changes made to their property. Photos, permits, and receipts can be useful if questions arise.

Unlike private appraisals, the Miami-Dade property appraisal process utilizes a mass appraisal model to value thousands of properties simultaneously.

This method analyzes recent sales of similar properties in each neighborhood to estimate market value for tax purposes.

Key factors considered include property location, recent sales prices, building features, and local market trends. Statistical models help ensure assessments are consistent within the area.

This approach enables the county to complete appraisals on time each year, adhering to the property appraisal timeline in Miami.

Residents should understand that mass appraisal values may differ from private appraisal figures, as the mass model uses averages and grouped data.

Once values are determined, the Miami-Dade office sends each property owner a TRIM (Truth in Millage) notice, usually in August. This notice explains the new assessed value, proposed property taxes, and dates for public budget hearings.

Owners have a deadline to review their TRIM notice and appeal if they believe there is an error. The notice will include instructions on how to file an appeal.

It is essential to verify all details for accuracy, including correct exemptions and property facts. Keeping all paperwork organized will help if an owner needs to respond quickly during this time.

Reviewing the TRIM notice as soon as it arrives helps prevent surprises later in the tax cycle.

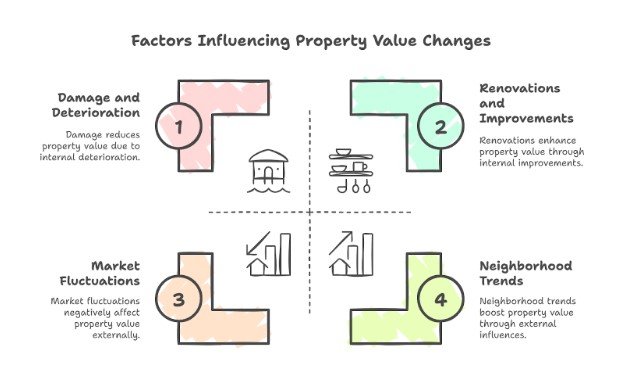

Property values in Miami-Dade can change for several reasons, which can impact property tax assessments. Many of these changes are linked to new construction, real estate trends, and even property conditions.

Upgrades such as adding a new room, installing a pool, or updating a kitchen can often increase a property’s value.

Miami-Dade tax assessors note these improvements and may reevaluate property values after building permits are closed or work is reported.

Some common improvements that trigger property tax reassessment in Florida include:

These changes must be reported, and the updated value usually reflects the added features. Homeowners should expect a higher assessed value if improvements raise the market value of the home.

The Property Appraiser’s office may use permits and inspections to track upgrades.

Shifts in the Miami real estate market can significantly impact property values, even without any physical changes to a home. High demand, new developments, or rising prices for nearby homes often lead to increased assessed values.

Local governments may reassess properties when home values climb across a neighborhood or city. A property tax reassessment can happen after comparable sales indicate property values have changed.

Neighborhoods with new amenities, better schools, or increased economic activity tend to see higher property values as a result.

Changes in nearby housing can also impact taxes, especially if upscale housing developments or commercial spaces increase overall property values in the area.

In Miami-Dade, these trends are closely monitored to ensure that tax assessments accurately reflect current market conditions.

Property values can go down if a home is damaged by fire, hurricane, or flooding. Deferred maintenance—such as a leaky roof or worn-out plumbing—may also lower value if noted by assessors.

Property tax reassessment triggers in Florida include both improvements and serious damage. Owners who qualify for exemptions (such as senior, disability, or homestead exemptions) may see value changes due to reduced taxable amounts.

These exemptions can lower the value for tax purposes, even if the market value remains the same. Assessors also review properties following disasters or reports of damage.

This ensures future tax bills are based on a home’s real, current condition and any legal exemptions. The process of property reassessment is designed to account for both positive and negative changes to a property.

Worried your home was overassessed this year? Home Value Inc. provides unbiased, local property tax appeal appraisals trusted by Miami-Dade residents. Schedule your review with us now.

If you’re ready to get started, call us now!

If a property owner feels their Miami-Dade property valuation is incorrect, there are clear steps to take.

Options range from discussing the matter with the appraiser’s office to initiating a formal appeal process and gathering strong evidence to support your case.

After receiving the property tax assessment, the first step in Miami-Dade is to contact the Property Appraiser’s Office for an informal review.

Property owners can reach out during the Interview Period, which is announced every August after notices are mailed out.

This provides an opportunity to ask questions, offer additional information, or bring errors to the staff’s attention directly.

Bringing recent sales information from similar homes, records of property damage, or copies of lease agreements can help.

Discussing the case at this stage is free and may sometimes result in the value being corrected without the need for an appeal. This option can save time and effort compared to a formal process.

If concerns are resolved during the informal review, no further action is needed.

If the informal review doesn’t fix the issue, a property owner can take the next step and file a formal appeal with the Miami-Dade Value Adjustment Board (VAB).

There are strict deadlines for filing, typically within 25 days after the Notice of Proposed Property Taxes is sent out.

The formal process allows the property owner to present their argument to a special board composed of appointed officials.

At the hearing, both the owner and the appraiser’s office can share documents, photos, and other evidence.

It’s also possible to have a representative or hire an attorney to help with the process.

Homeowners can review guidelines and steps for the property tax appeal process in Miami-Dade on the county’s website.

The VAB decision is final unless a further legal challenge is filed.

Good evidence is the key to a strong property tax appeal in Miami-Dade.

Owners should gather sales data from similar properties that sold at lower prices during the same period.

Lists and tables comparing square footage, age, and condition of these homes are very helpful.

Other useful documents include recent appraisals, photos that show property damage or required repairs, and contractor estimates for any necessary work.

Keeping records organized and labeled makes presenting a case easier.

It also helps to practice explaining why the property was valued too high and to be clear, respectful, and factual during meetings or hearings.

Home Value Inc. provides expert support for property owners facing tax appraisals in Miami-Dade.

Their services provide reliable analysis, local insights, and a straightforward process to address concerns about home value.

Home Value Inc. is recognized for its comprehensive property appraisals, which are utilized in tax appeals, refinancing applications, and other real estate transactions.

The appraisers have experience with Miami-Dade’s property appraisal system and stay current with market trends.

Property owners often use Home Value Inc. when they believe their tax assessment is too high.

They review the property’s features, condition, and recent sales in the neighborhood to prepare an accurate and fair report.

This report can help support tax appeals or provide data for refinancing and selling.

Clear communication sets them apart.

Homeowners can ask questions and get honest, practical answers.

The company debunks common appraisal myths and keeps property owners informed throughout the process.

The process with Home Value Inc. is simple and focused on transparency.

1. Connect: Property owners can reach out online, by phone, or in person to discuss their needs.

2. Evaluate: An appraiser visits the property, reviews its condition, and examines similar homes in the area.

They use local data and proven methods for their evaluation.

3. Report: Owners receive a comprehensive report that breaks down how their home value was determined.

The report explains the reasoning in clear, plain language for easy understanding.

This three-step process makes the appraisal straightforward and removes confusion.

Property owners know what to expect and have confidence in the final value provided.

Miami’s property tax system can seem complicated, but there are clear steps that help make it simpler.

Homeowners should keep track of important deadlines and stay updated on local tax policies. This can help prevent missed payments and confusion.

Using exemptions—like the well-known Homestead Exemption—can lower a home’s taxable value.

For those who use their property as a primary home, this can save money each year.

Small actions, like double-checking your assessment or applying for discounts, can make a real difference in what you end up paying.

Don’t navigate your TRIM notice alone. Home Value Inc. helps you challenge inflated values with a detailed real estate appraisal that withstands review. Reach out today to book yours.

How often are property tax appraisals conducted in Miami-Dade County?

Property tax appraisals in Miami-Dade are conducted annually. Each year, the Property Appraiser assesses the market value of properties as of January 1st, using market data, permits, and property records.

What triggers a property tax reassessment in Florida?

Major renovations, sales, new construction, damage, or permit activity can trigger a property tax reassessment in Florida. Homestead-protected properties are capped at a 3% annual increase, but non-homestead properties may see greater changes.

How do I appeal my property tax appraisal in Miami-Dade?

To appeal, file a petition with the Value Adjustment Board (VAB) within 25 days of receiving your TRIM Notice. You can request an informal review or hire a certified appraiser to strengthen your case with an independent valuation.

What is included in a property tax TRIM Notice?

The TRIM Notice shows your market value, assessed value, and taxable value, along with any exemptions. It also outlines proposed taxes from local taxing authorities and your right to appeal.

Does remodeling my home increase my property taxes in Miami?

Yes, significant remodeling (e.g., adding square footage or upgrading kitchens and bathrooms) can increase your assessed value, especially if permits are obtained. Cosmetic updates usually don’t trigger reassessment unless they impact market value.

What’s the difference between market value and assessed value in Florida?

Market value refers to the amount your property could sell for. In contrast, assessed value is a calculated amount used to determine your tax bill, which is often lower than market value due to exemptions and Save Our Homes caps.

Home Value Inc. performs residential and commercial appraisals for its clients in greater Miami-Dade County and the following cities in South Florida. We provide services to the following cities -