SPEAK WITH AN APPRAISER

(786) 357-6511

Do you know how much your home is worth, or are you just guessing?

That number could change your future. Whether you’re selling, refinancing, or just curious, knowing your property’s value isn’t just helpful—it’s powerful.

In fact, according to the National Association of Realtors, 36% of homeowners overestimate their home’s value. That gap can cost you thousands.

But property valuation doesn’t have to be confusing or stressful. With the right guidance, it’s a step-by-step process anyone can follow.

The process might seem complex, but breaking it down into manageable steps makes it accessible.

You can take multiple approaches to determining your property’s true worth, from researching comparable sales to using online tools.

Whether you’re planning to sell soon or are just curious about your home’s current market position, knowing how to conduct a proper property valuation puts you in control.

This guide will cover everything you need to know, from basic concepts to practical techniques you can apply today.

Property valuation determines how much a property is worth in the current market.

Understanding this process helps you make better investment decisions and can save you thousands when buying or selling real estate.

When valuing property, market trends are crucial in determining what a home is worth.

Supply and demand fundamentally drive these values—prices typically rise when more buyers compete for limited properties.

Location remains one of the factors that affects property value the most.

Properties in desirable neighborhoods with good schools, low crime rates, and convenient amenities command higher prices. Even within the same city, values can vary dramatically by neighborhood.

You need to understand the difference between:

Economic factors that impact house values include:

When tracking real estate market trends, pay attention to average days on the market, listing-to-sale price ratios, and inventory levels.

These indicators help you gauge whether you’re in a buyer’s or seller’s market.

Property valuation reports provide an unbiased opinion based on a thorough analysis of comparable properties, property condition, and current market conditions.

Home Value Inc. specializes in helping homeowners like you understand their property’s worth. Contact us today for a quick consultation regarding your next tax appeal or valuation need.

If you’re ready to get started, call us now!

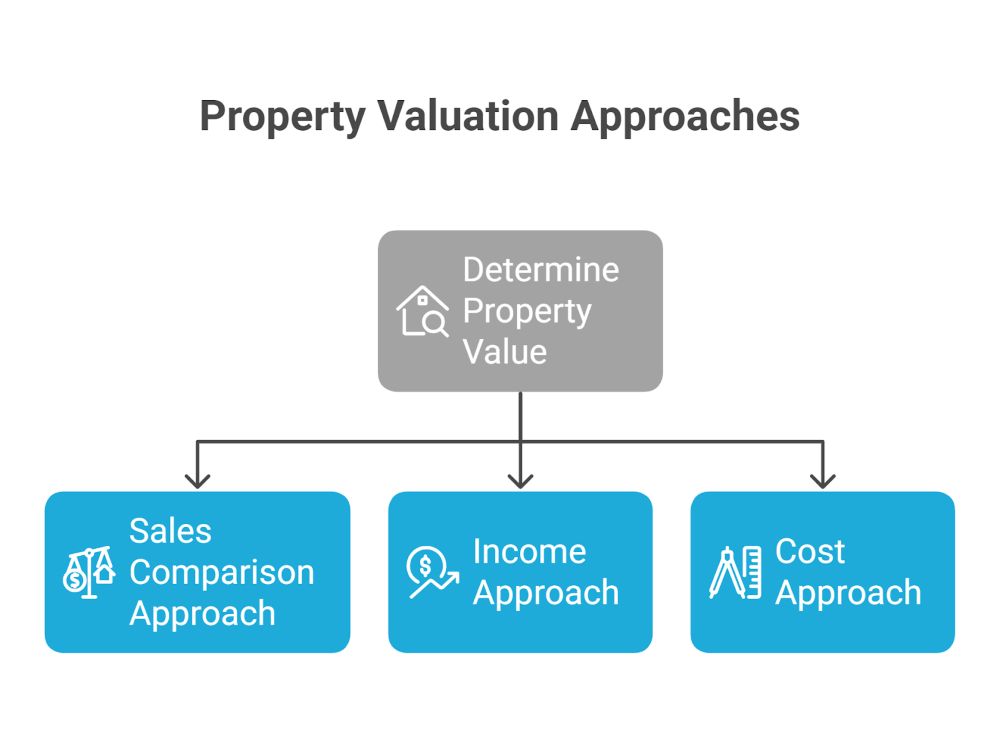

When determining property value, professionals rely on three main approaches that analyze different aspects of a property.

Each method offers unique insights based on market data, income potential, or replacement costs.

The Sales Comparison Approach (the Market Approach) compares your property to similar properties recently sold in your area.

This is the most common method for residential properties and is what most homeowners are familiar with.

To determine house value before selling, you’ll analyze comparable properties or “comps” with similar:

Adjustments are made for differences between your property and the comps.

For example, if your home has one more bathroom than a comparable property sold for $300,000, you might add $15,000 to estimate your property’s value.

Real estate agents often use this method when preparing a Comparative Market Analysis (CMA) for clients. It’s considered reliable when there are sufficient recent sales of similar properties.

The Income Approach focuses on a property’s ability to generate income, making it ideal for investment properties like apartments, office buildings, and shopping centers.

This method answers: “How much is this property worth based on the income it produces?”

To calculate property value accurately using this approach, you’ll:

The formula is simple: Value = NOI ÷ Cap Rate

For example, if a rental property generates $50,000 in annual NOI and similar properties in the area sell at a 5% cap rate, the estimated value would be $1,000,000 ($50,000 ÷ 0.05).

Investors prefer this method as it directly ties value to cash flow potential. The accuracy depends on having reliable income and expense figures.

The Cost Approach calculates the cost of rebuilding your property from scratch, plus the value of the land. This method is beneficial for unique or special-purpose properties and new construction.

The real estate valuation method follows this basic formula:

Property Value = Land Value + (Construction Cost – Depreciation)

You’ll need to:

This approach works best for newer properties since estimating depreciation becomes more complicated with older buildings.

Insurance companies often use this method when determining replacement value for coverage.

The Cost Approach is less common for standard residential valuations but provides valuable insights when other methods aren’t applicable, such as for churches, schools, or historical buildings.

Are you thinking about refinancing or selling soon? Home Value Inc. can provide an accurate, up-to-date home value appraisal tailored to your neighborhood and current market conditions. Contact us now.

If you’re ready to get started, call us now!

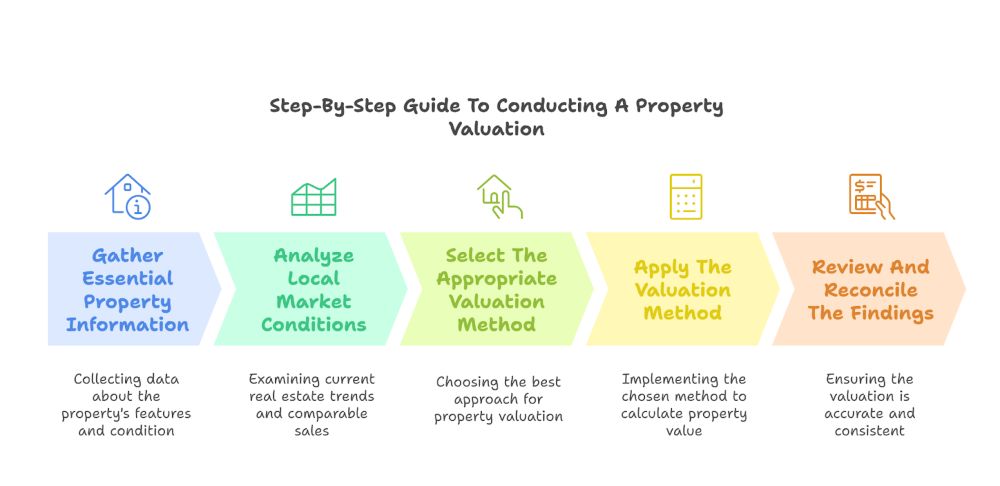

Properly valuing a property requires a systematic approach that considers multiple factors to arrive at an accurate figure.

Following these steps will help you determine the true value of a property while minimizing errors in your assessment.

Begin by collecting all relevant data about the property. This includes:

Take photos and detailed notes during your property inspection.

Create a property inspection checklist to ensure you catch important features like storage space, energy efficiency upgrades, or structural issues.

You should also obtain floor plans or create a basic layout sketch. This documentation will provide reference points when comparing with similar properties later in the process.

Real estate values are heavily influenced by location and current market trends. Your analysis should include:

Use online resources and MLS data to compile this information.

Create a simple table comparing key metrics:

| Market Factor | Status | Impact on Value |

| Sales Trend | Rising/Stable/Declining | High/Medium/Low |

| Inventory Levels | High/Moderate/Low | Negative/Neutral/Positive |

| Days on Market | Above/Below Average | Negative/Positive |

This market analysis helps establish the baseline for your property valuation and identifies factors that might affect demand.

Choose the valuation technique that best suits your property type and available data:

Sales Comparison Approach: Most common for residential properties. Identify 3-5 recently sold comparable properties and adjust their values based on differences from your subject property.

Income Approach: This approach is ideal for rental properties. Calculate the Net Operating Income (NOI) and apply a capitalization rate to determine value.

Cost Approach: This approach works well for unique or newly constructed properties. Calculate the cost to replace the building plus land value minus depreciation.

Gross Rent Multiplier (GRM): A quick method that divides property price by gross annual rental income to create a comparative metric for rental property valuation.

Your property type, available data, and intended use of the valuation will determine which method provides the most accurate results.

Once you’ve selected your method, apply it thoroughly and systematically:

For the Sales Comparison Approach:

For the Income Approach:

Document each calculation step. Create a spreadsheet to organize your data and perform calculations. This methodical approach ensures your house valuation has a solid foundation that can withstand scrutiny.

In this final step, you’ll analyze and reconcile any differences between valuation methods:

Your final valuation should include a range rather than a single figure. For example, “$450,000-$475,000” provides a realistic value span that accounts for market variability.

Be prepared to explain how you arrived at your conclusion. Document your methodology, data sources, and any assumptions made during the process. This transparency builds credibility in your valuation work.

Certain mistakes can cost thousands of dollars and lead to poor investment decisions when valuing property.

These errors often stem from incomplete analysis or overreliance on limited information sources.

Market conditions can change rapidly, significantly affecting your property’s value. Many property owners ignore local trends, leading to inaccurate valuations.

To avoid this pitfall, use multiple online estimators rather than relying on just one.

Remember that online home value estimators typically have a margin of error between 5% and 20%.

Monitor these market indicators regularly:

Create a spreadsheet of comparable sales from the last 3-6 months for a DIY valuation. This recent data will better reflect current market conditions than outdated information.

A common appraisal mistake is focusing solely on square footage while overlooking unique property characteristics. Your home’s specific features significantly impact its true market value.

Consider these often-overlooked factors:

While free valuation tools provide a starting point, they can’t account for your property’s unique condition or features. Consider a professional appraisal for a more accurate assessment.

Take detailed photos of distinctive features and improvements when requesting professional valuations.

This documentation helps ensure that appraisers don’t miss value-adding elements that automated tools might overlook.

Property valuation doesn’t have to be complicated. Following the steps outlined in this guide, you can approach the process with confidence and clarity.

Remember that engaging a professional valuer leads to the most accurate results. These experts bring experience and market knowledge that’s hard to match.

For DIY approaches, the market comparison method remains one of the most reliable. Comparing similar properties in your area provides a solid baseline.

Online valuation tools can offer quick estimates but should supplement rather than replace more thorough methods.

Documentation is crucial throughout the process. Keep records of all inspections, comparisons, and calculations.

An accurate property valuation empowers you to make informed decisions. The time invested in proper valuation often pays dividends through better financial outcomes.

Stay objective and realistic about your property’s value. The goal isn’t the highest possible number but the most accurate one.

Know your property’s true worth before making your next move. Home Value Inc. offers certified real estate appraisals across Miami—get your comprehensive appraisal report started today.

What is property valuation, and why is it important?

Property valuation is the process of determining the current worth of a property based on factors like location, condition, size, and market trends. It’s essential for buying, selling, refinancing, tax assessments, and legal matters like divorce or estate planning.

How is a house valued step by step?

To value a house step by step:

What is the most accurate method of property valuation?

The sales comparison approach is often the most accurate for residential homes. It compares your property to recently sold homes with similar features, adjusting for differences to reflect current market value.

What factors affect a property’s value the most?

Key factors affecting property value include:

Can I estimate my property value without an appraiser?

You can estimate property value using online tools, public records, and comparable home sales. However, for legal or financial accuracy, a licensed appraiser provides a formal valuation that banks and courts recognize.

How often should you get your property revalued?

It’s recommended to get a property revalued every 1–3 years, or sooner if:

What’s the difference between appraised value and market value?

Appraised value is a professional estimate provided by a certified appraiser, often used in lending and legal matters. Market value reflects the price a buyer is willing to pay in the open market, which may fluctuate based on demand.

Home Value Inc. performs residential and commercial appraisals for its clients in greater Miami-Dade County and the following cities in South Florida. We provide services to the following cities -